Post-Market Price Changes Alone Account for Most Recent Spending Growth for Biologics, and Rebates Have Little Impact

Annual spending by U.S. public programs and beneficiaries on biologics nearly doubled from $5.3 billion to $10.3 billion from 2012 to 2016.

Annual spending on biologics by U.S. public programs and beneficiaries nearly doubled from 2012 to 2016, according to research presented at the 2019 ACR/ARP Annual Meeting in Atlanta. Post-market drug price changes alone accounted for the majority of recent spending growth, and manufacturers’ rebates have little impact on rising costs.

The American public spends billions of dollars each year on biologics, but it is still unclear what factors are driving recent increases in spending and per-patient costs for these drugs. This statistical cost analysis characterized changes in total spending and unit prices for biologics in Medicare and Medicaid and quantified the major sources of spending increases on biologics for public programs and their beneficiaries. Rising drug costs were the main reason for the new study.

“The potential drivers of biologic spending increases have different implications for patient and taxpayer expenditures, and ways to control costs,” says Natalie McCormick, PhD, post-doctoral fellow at Massachusetts General Hospital and Harvard Medical School, and the study’s lead author. “If more patients are receiving biologics, total spending may increase, but the average costs for each patient may not. In contrast, price increases can have a considerable impact on patients’ out-of-pocket costs, as biologics are in specialty tiers where patients pay a percentage of the list price, not a copayment. This can have financial and clinical consequences, as high out-of-pocket costs have posed barriers to biologic initiation and adherence.”

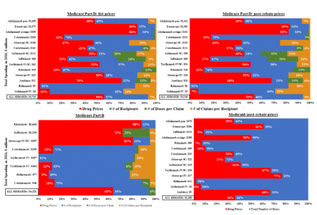

The researchers accessed Medicare Parts B and D and Medicaid drug spending data from 2012 to 2016. These data contained aggregated prescription claims for all beneficiaries enrolled in Medicare Part B (fee for service) and Part D (stand-alone or Medicare Advantage Plans), or Medicaid. All biologics approved by the U.S. Food and Drug Administration (FDA) for one or more rheumatic diseases through December 2014 were included in the study. For each biologic and calendar year, the researchers extracted total annual spending, and number of recipients, claims and doses dispensed, and then calculated the drug unit price or average cost per dose.

For the statistical analysis, they calculated five-year changes in total spending and unit prices for each biologic and in-aggregate, after adjusting for general inflation to 2016 dollars. Then, they isolated the contributions of four sources of spending growth: drug prices, number of recipients (or uptake), treatment intensity (the mean number of doses per claim) and the annual number of claims per recipient for each biologic. They conducted their analysis by including statutory Medicaid rebates, as these decrease public spending, and both excluding and including Medicare rebates, as these are paid by drug manufacturers to pharmacy benefit managers (PBMs) and Part D plans, but do not directly impact patient or taxpayer spending. They used time-varying rebates reported by the Congressional Budget Office.

The study’s results showed that from 2012 to 2016, annual spending by U.S. public programs and beneficiaries nearly doubled from $5.3 billion to $10.3 billion for the 11 biologics included in the study. Drug prices increased by a mean of 52 percent in Medicare Part D and 20 percent in Part B. Controlling for general inflation, unit price increases alone accounted for 56 percent or $1.7 billion of the five-year, $3.0 billion spending increase within Part D. Increased uptake accounted for 37 percent or $1.1 billion. After they accounted for time-varying rebates, price hikes for these drugs were still responsible for 53 percent or $1.4 billion of the Part D spending increase.

Adalimumab and etanercept, two of the oldest biologics, were prescribed to the largest numbers of Part D beneficiaries and also had the biggest unit price increases. Medicaid spending and price trends were similar to Part D. The majority of spending growth for the oldest Part B drugs--rituximab, abatacept and infliximab--was due to price increases, while increases in the number of recipients was the main driver of spending growth for the five newer drugs—golimumab, ustekinumab, tocilizumab, certolizumab and belimumab.

“With prices increasing, our findings underlie the importance of rheumatologists and patients discussing the costs of DMARD treatment and options for mitigating cost concerns and barriers to effective treatment. These will differ depending on each patient’s financial circumstances and extent of their Medicare coverage,” says Dr. McCormick. “We did not have access to individual-level data in this study but would like to investigate how price increases may impact patients’ out-of-pocket costs and adherence to therapy over the long term, and which diagnoses had the biggest increases in biologic uptake. It will also be interesting to assess the impact of biosimilars on public spending.”

This research was supported by funding from the Canadian Institutes of Health Research, Rheumatology Research Foundation and the NIH’s National Institute of Arthritis and Musculoskeletal and Skin Diseases.

Facebook Comments